How big brends like Angie, LendingTree, Progressive Qualify Lead using Forms

Have you ever wondered how big brands turn website visitors into qualified leads? Companies like Angie, LendingTree, and Progressive have mastered this process with one simple tool: the lead capture form.

In this article, we’ll break down how each brand uses lead forms to qualify users, segment them, and drive conversions. Plus, you’ll see how smaller businesses can replicate their strategies using tools like Tapform.

What Is a Lead Capture Form?

A lead capture form is a web form that collects user information: name, email, phone number, preferences - in exchange for something of value (like a quote or estimate).

But it’s not just about gathering data. For big brands, the form is the first filter that qualifies the user:

- What are they looking for?

- Where are they located?

- Are they ready to buy or just browsing?

Does a Multi-Step Form Really Increase Conversions?

A real-world case study by UX designer Josh Jennings shows exactly how this works. By redesigning a clunky single-step form into a user-friendly multi-step format, an HVAC service company boosted its conversion rate by +5.51%.

Same traffic. Same offer. More conversions.

Conversion optimisation isn't about hype - it's about data. This A/B test ran over 854 sessions (individual visits), splitting users evenly between the old and the new form. The result? A statistically significant improvement with 95% confidence.

Here are the numbers:

| Version | Conversion Rate |

|---|---|

| Control (Old Form) | 7.62% |

| Variant (Multi-Step Form) | 13.13% |

That’s a +5.51% lift—purely by rethinking form design, reducing friction, and applying proven UX principles.

Now, let’s explore how real companies use lead capture forms—and how individuals and small businesses can implement them too.

How Do Top Brands Use Lead Capture Forms to Prioritise and Convert?

The previous case study showed how a multi-step form improved conversions. But what happens when we look beyond one company and industry?

Brands across home services, finance, and insurance all rely on short, smart lead forms-not just to collect contact details but to prioritize leads and personalize follow-ups. Whether it's Angi, LendingTree, or Progressive, each uses form structure to match users with the right service, product, or quote.

Despite different markets, they share one key approach: They don’t ask everything at once. They ask just enough to qualify interest.

Let’s break down how each of these companies captures and qualifies leads efficiently.

Angie

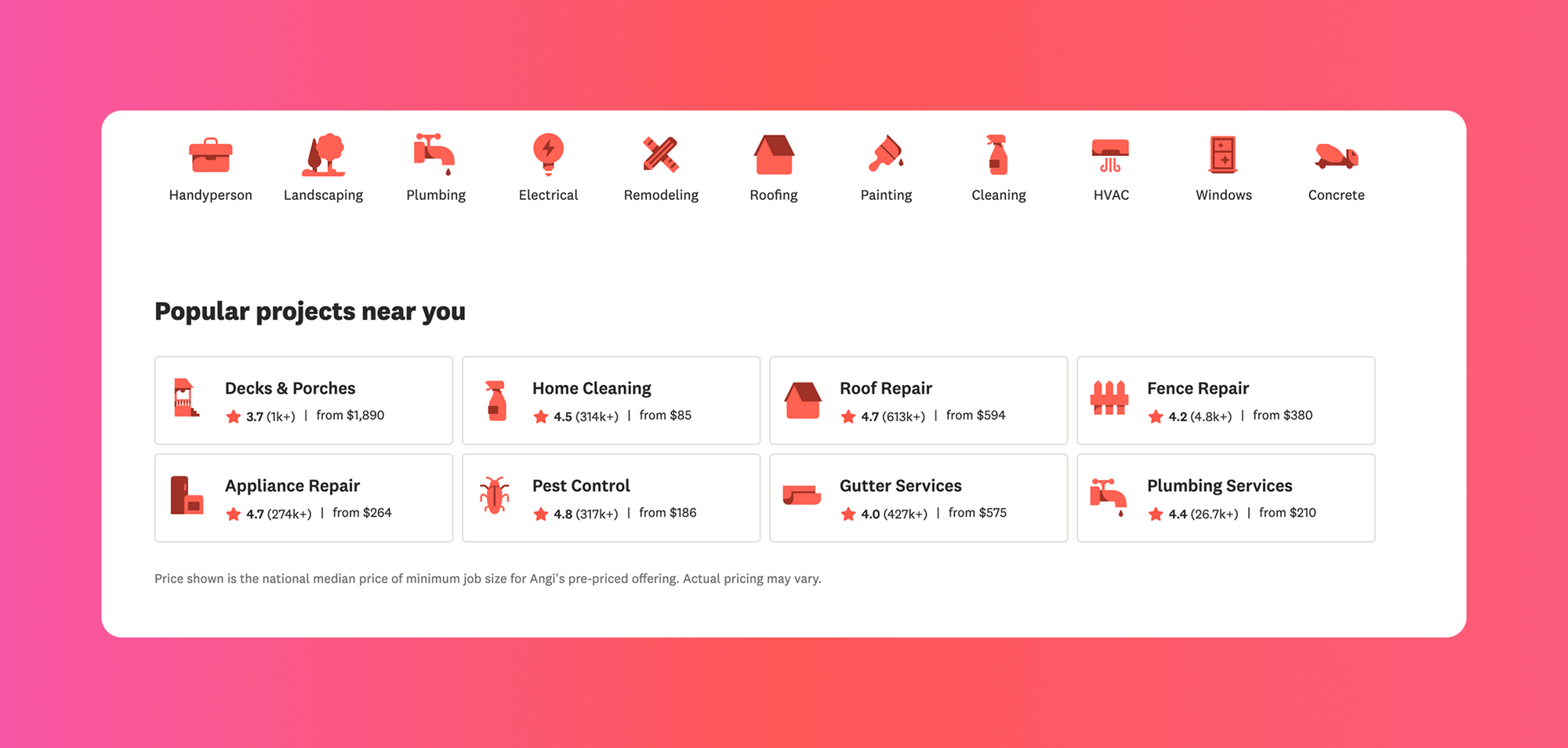

Angi (formerly Angie’s List) is a platform that connects homeowners with local service professionals for tasks like plumbing, landscaping, remodeling, and repairs.

It allows users to search, compare, and book verified professionals based on reviews, pricing, and service type.

The platform streamlines home service hiring by offering scheduling tools, financing options, and project cost guides.

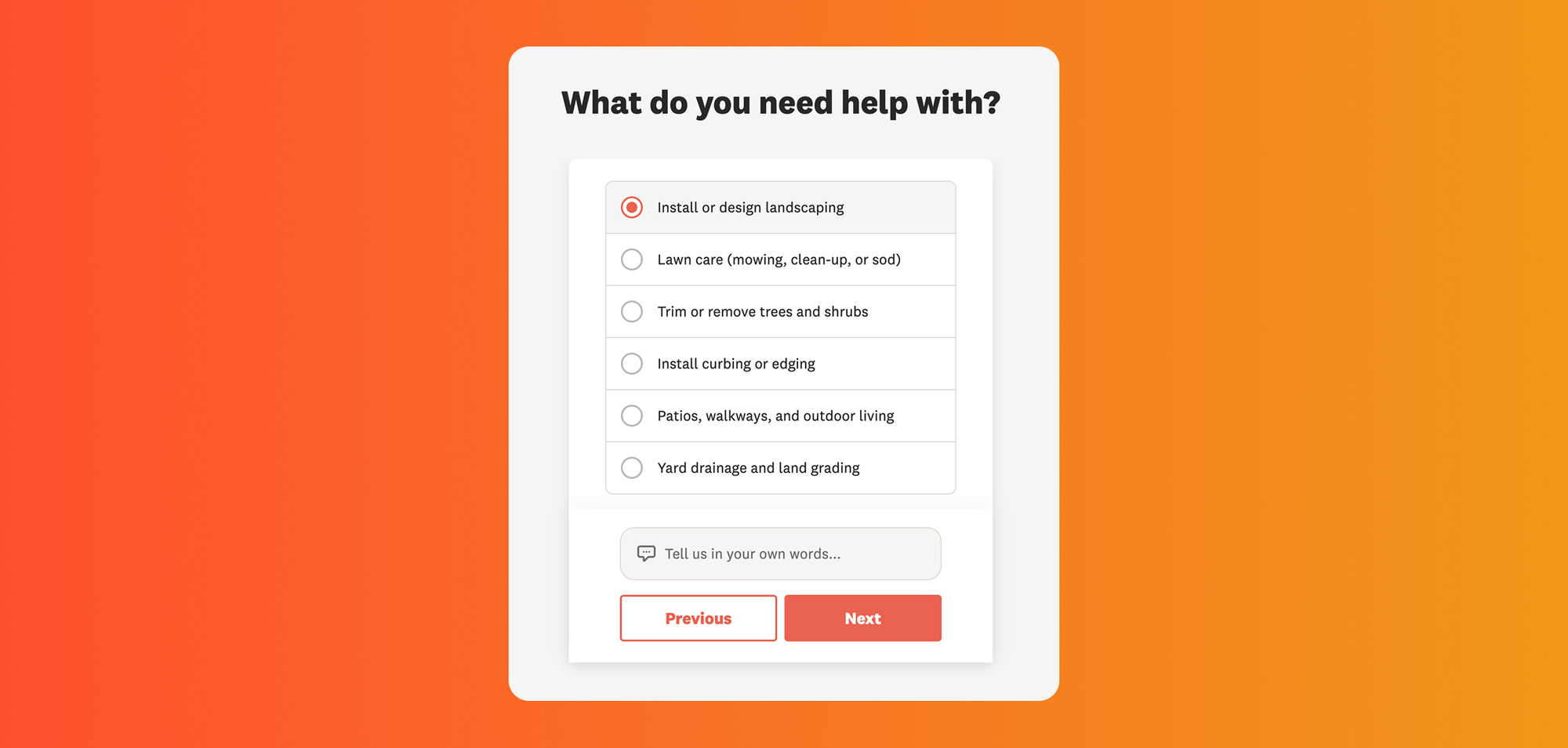

What makes Angi’s lead capture form effective is that it’s tailored specifically for home services. Each form features clearly defined, relevant questions to extract the most important information from every lead.

One unique element is the "Tell us in your own words" input. This gives users the chance to describe their needs in detail if their issue doesn’t fit the standard form options - providing Angi with better insights and more context.

LendingTree

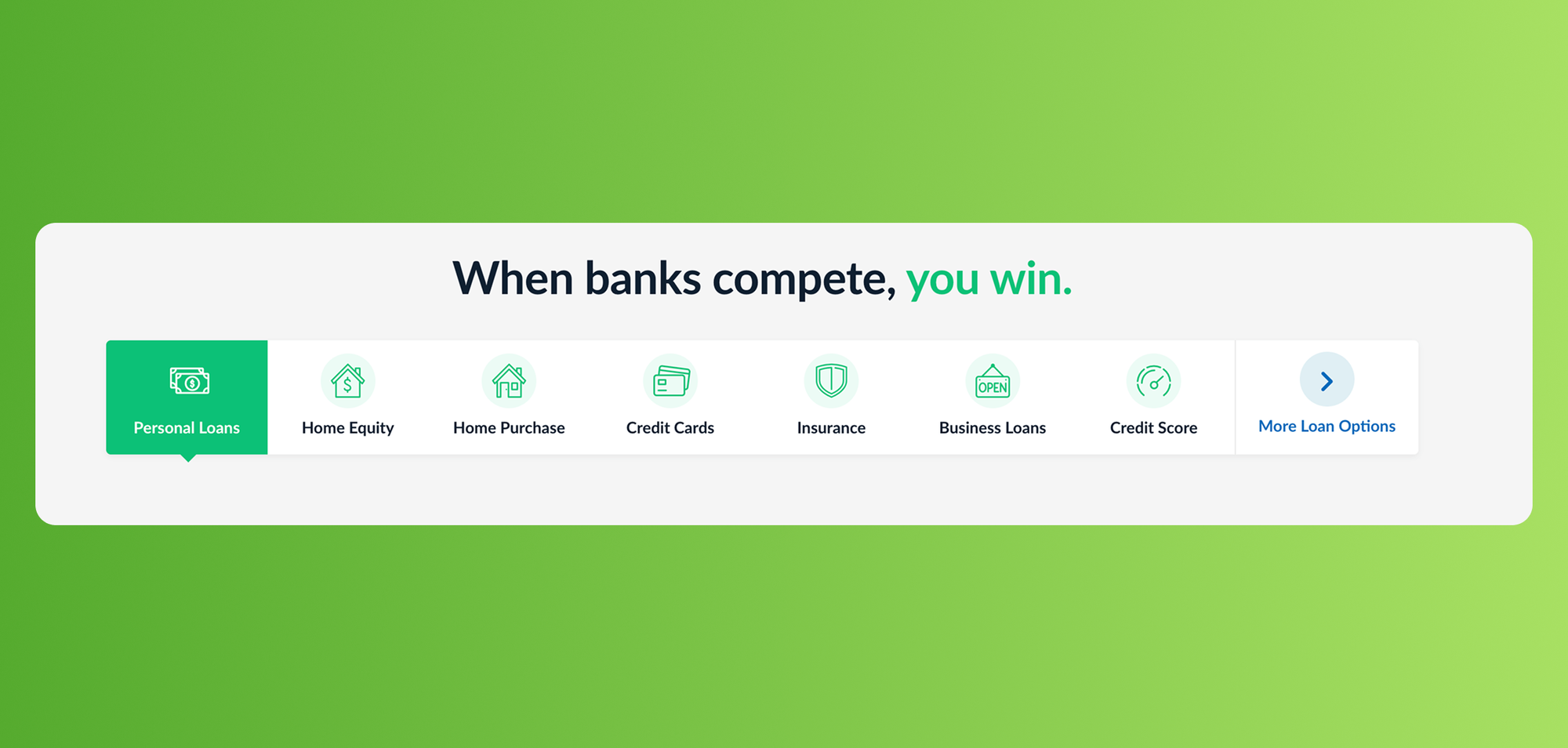

LendingTree is an online marketplace that connects borrowers with multiple lenders for mortgages, personal loans, auto loans, and credit cards.

LendingTree helps users compare personalised offers in one place, making the borrowing process faster, easier, and more transparent.

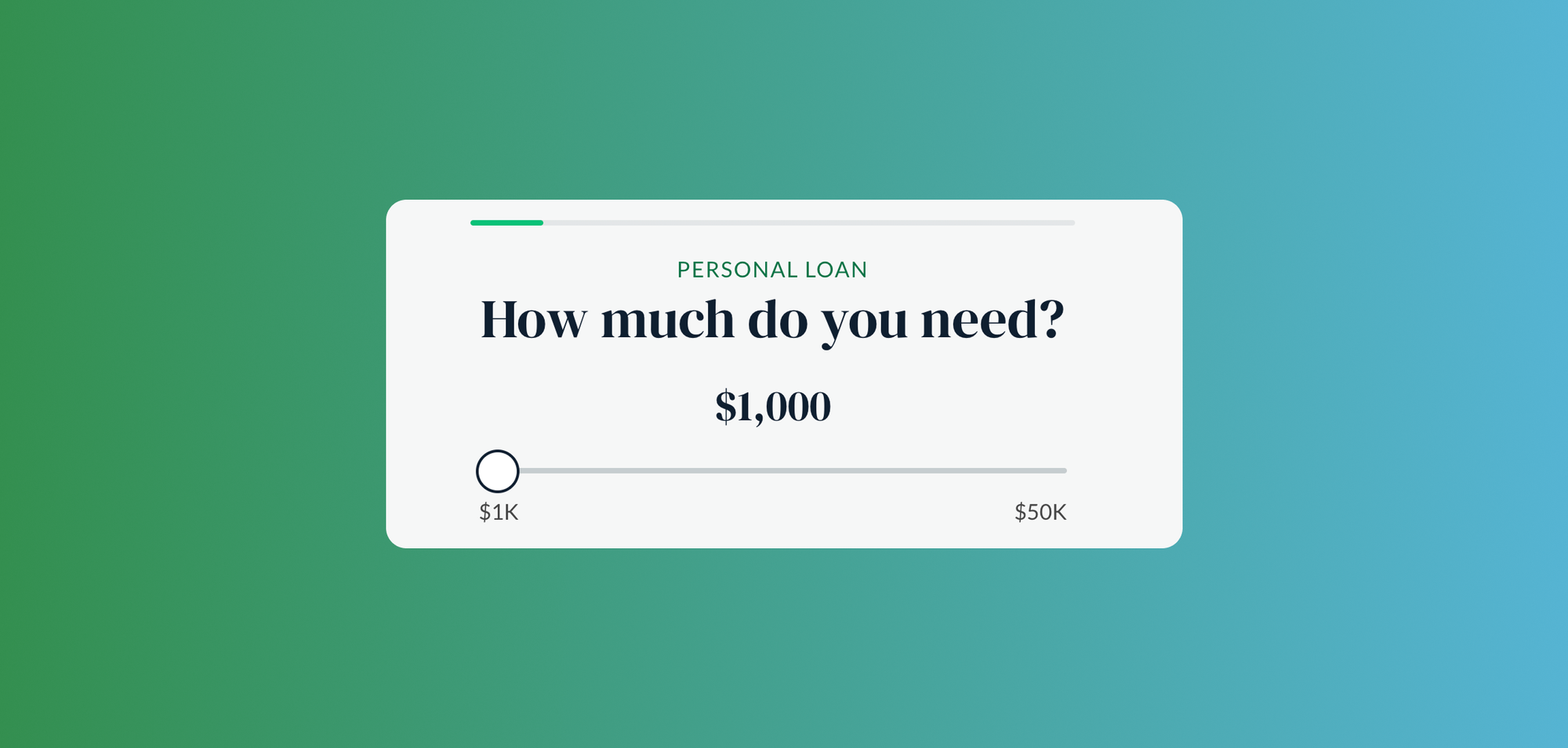

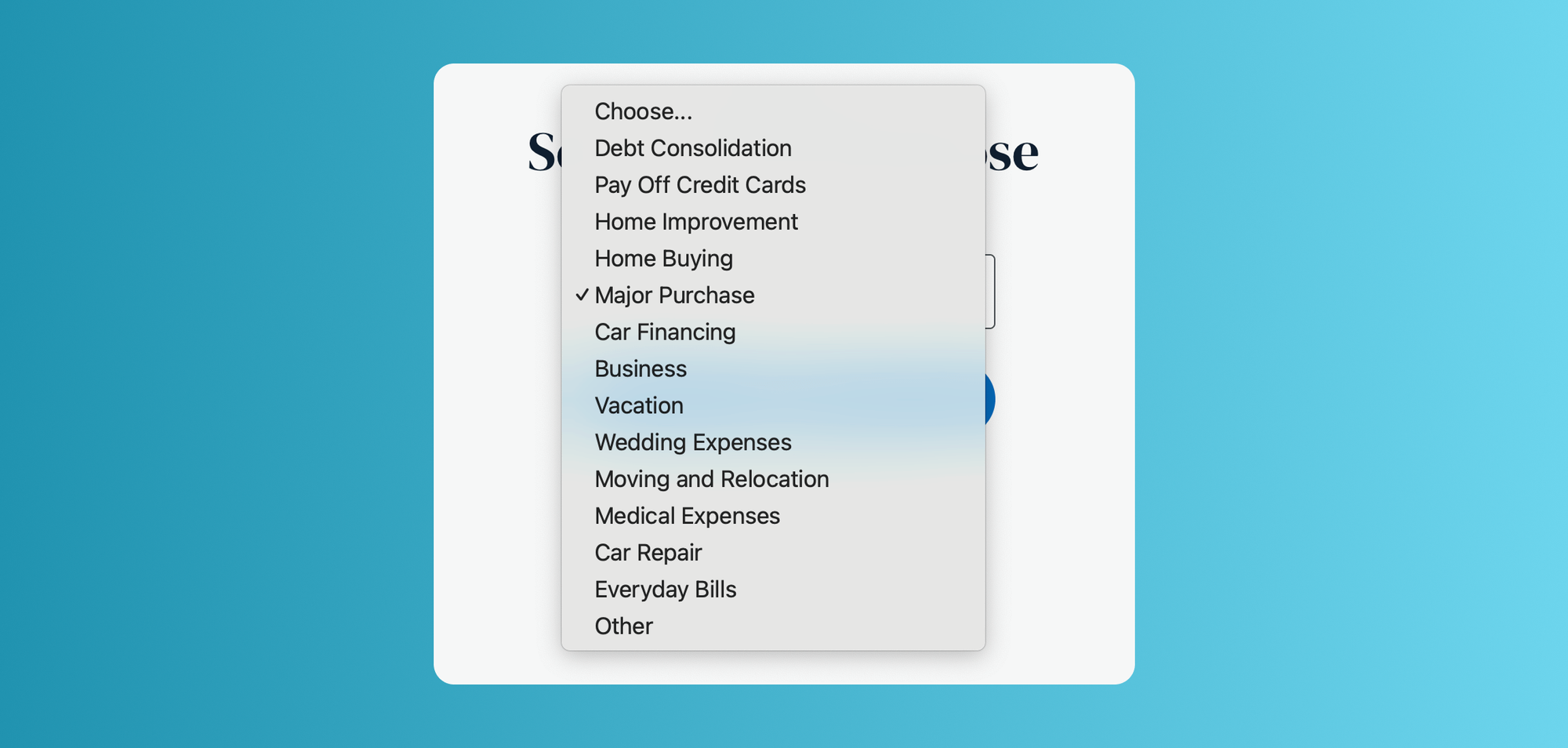

LendingTree, like Angi, uses lead capture forms tailored specifically to their services in order to qualify better and segment their leads.

Their forms are designed to match financial needs, guiding users through relevant questions based on the product they're interested in.

What stands out in their approach is the use of dropdown menus and price sliders in some forms, adding interactivity and making the experience feel more intuitive.

While their style differs from Angi’s, it’s equally effective - focused on clarity, simplicity, and collecting the most relevant data.

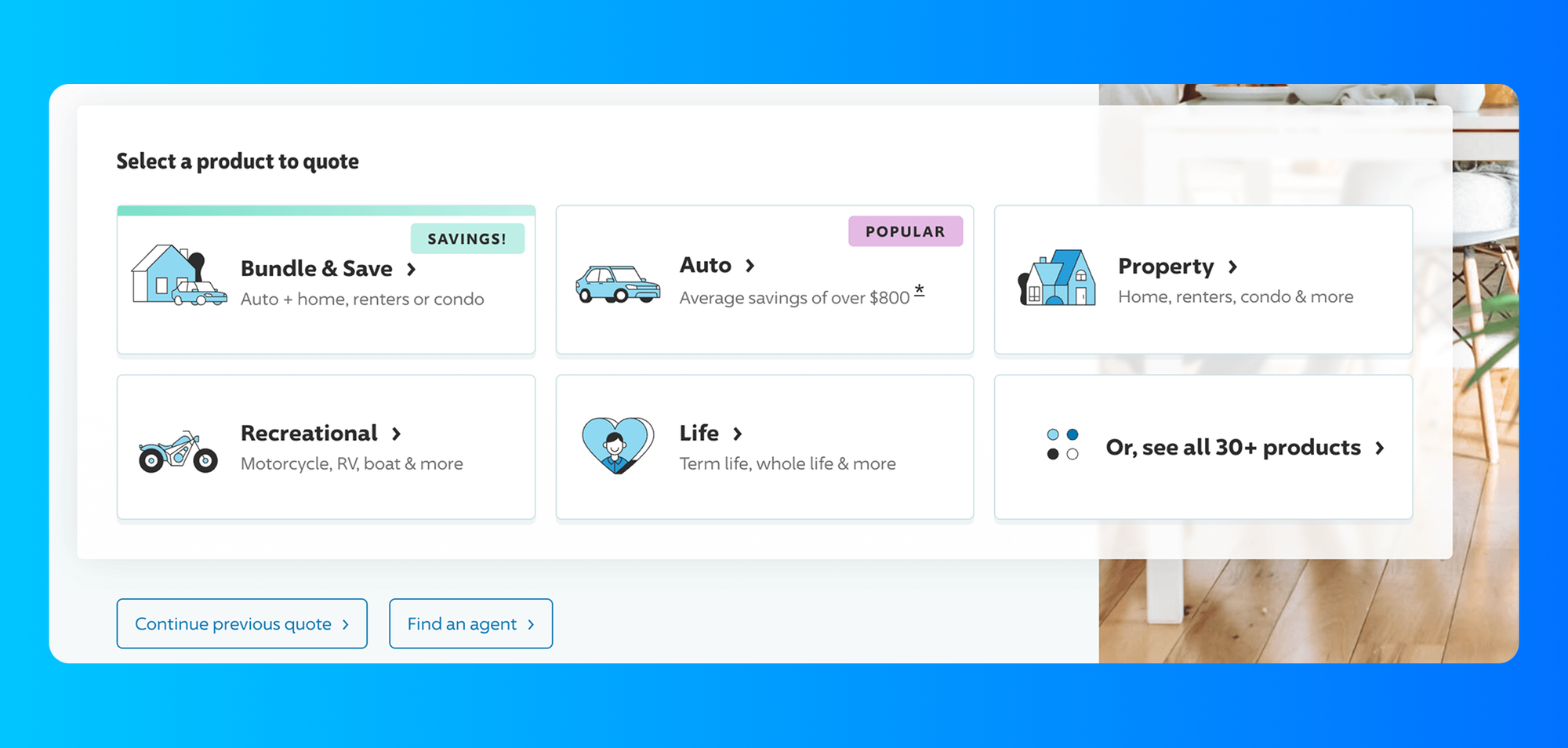

Progressive

Progressive is a major insurance provider offering coverage for auto, home, renters, motorcycles, and more across the United States.

It allows users to compare personalised insurance quotes online based on location, vehicle, and coverage needs - all from one platform.

The platform streamlines policy shopping with instant quotes, bundling options, and tools to fit any budget.

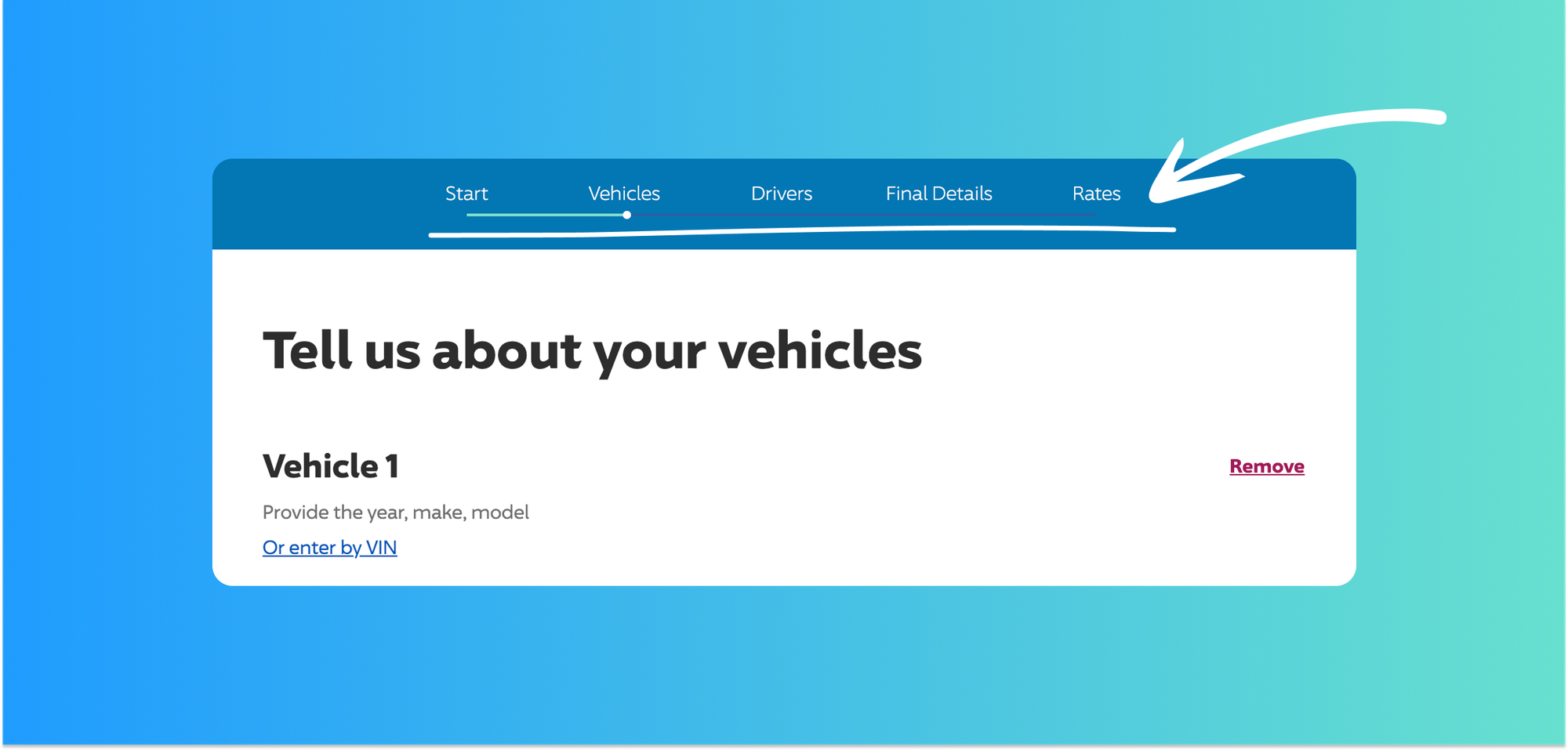

Progressive has the longest lead capture forms among the brands mentioned, which is understandable given the nature of the insurance industry and the need for detailed information.

If your business also requires forms with many input fields like Progressive, it's a good idea to include a visible progress indicator at the top of the form to guide users through the journey and prevent early drop-offs.

What These Brands Have in Commonpersonalised?

Successful brands like Angi, LendingTree, and Progressive don’t guess when qualifying leads. They apply consistent, data-driven strategies that perform reliably across industries.

1. Early segmentation guides the journey.

Users are segmented from the first question. Each answer triggers a relevant path- whether it's service type, budget range, or location. Brands don’t wait until the final step to categorise leads.

2. Every question serves a defined purpose.

They avoid long, confusing forms. Each field is intentional—designed to qualify interest or disqualify mismatches. This reduces friction and boosts completion rates.

3. Automation delivers instant next steps.

After submission, users receive quotes, matches, or offers without delay. This immediate feedback loop increases engagement and prevents leads from dropping off.

These principles increase conversion by respecting the user’s time and delivering clear value fast. They balance data collection with a seamless user experience—resulting in more qualified leads and better close rates.

Why Does Creativity Matter in Lead Capture Form Design?

While proven principles drive conversions, creativity determines differentiation. No two businesses should use identical forms—because no two audiences behave the same.

The examples from Angi, LendingTree, and Progressive show this clearly:

- Angi personalises forms for home repairs.

- LendingTree adjusts form logic based on loan type.

- Progressive uses detailed flows for insurance quoting.

Each form structure reflects the service type, sales cycle, and user intent.

Creativity shapes the user journey.

Brands experiment with visuals, question phrasing, field types, and logic paths. Some use open-text boxes. Others use sliders, dropdowns, or progress bars.

Form design must match business goals.

An HVAC service doesn’t need the same inputs as a loan marketplace. A freelancer booking page won’t convert with the complexity of an insurance application.

Creativity ensures the form feels tailored, not templated. It aligns form flow with user psychology and decision stage—turning static data collection into dynamic lead generation.

How Small Businesses Can Generate Leads Like Big Brands?

The gap between small businesses and industry leaders isn't just budget - it's strategy.

While Angi, LendingTree, and Progressive invest heavily in custom development, smaller companies can achieve similar results using modern form-building platforms.

The key lies in understanding that these successful brands don't just collect contact information. They use forms as qualification tools, gathering the exact data needed to prioritise leads and personalise follow-ups.

Start with strategic questioning

Instead of generic "Tell us about your project" fields, ask specific questions that mirror your sales process. A landscaping company might ask about property size, preferred services, and budget range. A consultant could inquire about company size, current challenges, and timeline for implementation.

Implement progressive disclosure

Break complex forms into logical steps, showing only relevant questions based on previous answers. This approach reduces cognitive load and increases completion rates - just like the HVAC company that saw a 5.51% conversion lift.

Automate the immediate response

The moment someone submits a form, they should receive valuable content: a preliminary quote, a relevant resource, or clear next steps. This instant gratification keeps prospects engaged while you prepare personalised follow-up.

Modern tools like Tapform make this accessible to any business. You can create multi-step forms with conditional logic, integrate with existing systems, and track performance metrics - all without technical expertise or enterprise budgets.

The companies dominating your market aren't necessarily spending more on lead generation. They're just being smarter about how they capture and qualify prospects from the start.

Conclusion

Your competitors aren't necessarily spending more on lead generation; they're just being smarter about it. While you're collecting names and emails, they're qualifying prospects, segmenting by intent, and automating follow-ups.

Today, you don't need enterprise budgets to compete. The same strategies that work for Angi, LendingTree, and Progressive can work for your business too.

Start simple, replace generic contact forms with strategic questions that mirror your sales process. Break complex forms into steps. Deliver immediate value after submission.

Your website traffic is already there. Make sure your forms are working to convert it.